In an era where virtually every business has an online presence and news travels at the speed of light, negative information can spread quickly and widely, causing significant damage to a company’s brand and bottom line. Reputational harm coverage, an increasingly important but often overlooked insurance, safeguards your company’s financial assets in the face of a covered risk, such as a data breach, a product recall, or a damaging social media campaign. This protection is essential for every company, regardless of its size.

What is Reputational Harm in Business? Is Your Company At Risk?

What is Reputational Harm in Business? Is Your Company At Risk?

Reputational harm refers to the tangible financial loss a business suffers due to damage to its brand image or public reputation. It’s not about hurt feelings; it’s about a quantifiable decline in sales, a loss of key clients, or a drop in customer trust. In Florida’s competitive markets, from Florida’s Southwest Coast to the growing inland communities of Lakeland, a company’s reputation is its most valuable asset. The fact is that every company is exposed to some degree of reputational risk. A single negative post, a viral video, or a widely reported business incident can trigger a crisis, and without the right coverage, your financial assets are exposed.

Why Your Business Needs Reputational Harm Insurance

This insurance provides financial relief from the direct and indirect costs of a reputation crisis. It can cover the expenses of a public relations firm, marketing campaigns to restore your brand’s image, and, in some cases, the financial losses incurred from a drop in revenue or a cancellation of contracts. It provides a financial lifeline that enables your business to recover and regain its trust in the community.

What it covers and doesn’t cover:

What it Covers

Reputational harm insurance typically covers financial losses and the cost of crisis management following a sudden and specific event, such as a cyberattack, a product recall, or a public health scare. It’s intended for acute events that have a clear start and end point, providing thorough coverage for a wide range of potential crises.

What It Doesn’t Cover

This insurance does not cover damages caused by a pre-existing poor reputation, a pattern of bad customer service, or general business mismanagement. It’s not a substitute for running your business responsibly; it is protection against a sudden, unforeseen crisis.

How Much Does it Cost?

The cost of reputational harm coverage is highly variable. It depends on several factors, including the size of your company, your industry’s risk profile, and your existing cybersecurity protocols. A tech company with a high risk of data breaches will likely have a different premium than a small local service provider. The cost of a premium is a small price to pay compared to the potentially massive financial losses from a damaged reputation.

Other Business Liability Insurance Coverage Options

Reputational harm coverage often works in tandem with other policies, including:

- Commercial General Liability (CGL): Covers common risks like bodily injury and property damage.

- Cyber Liability Insurance: Specifically protects against data breaches and cyberattacks.

- Errors & Omissions (E&O) Insurance: Protects against claims of professional negligence.

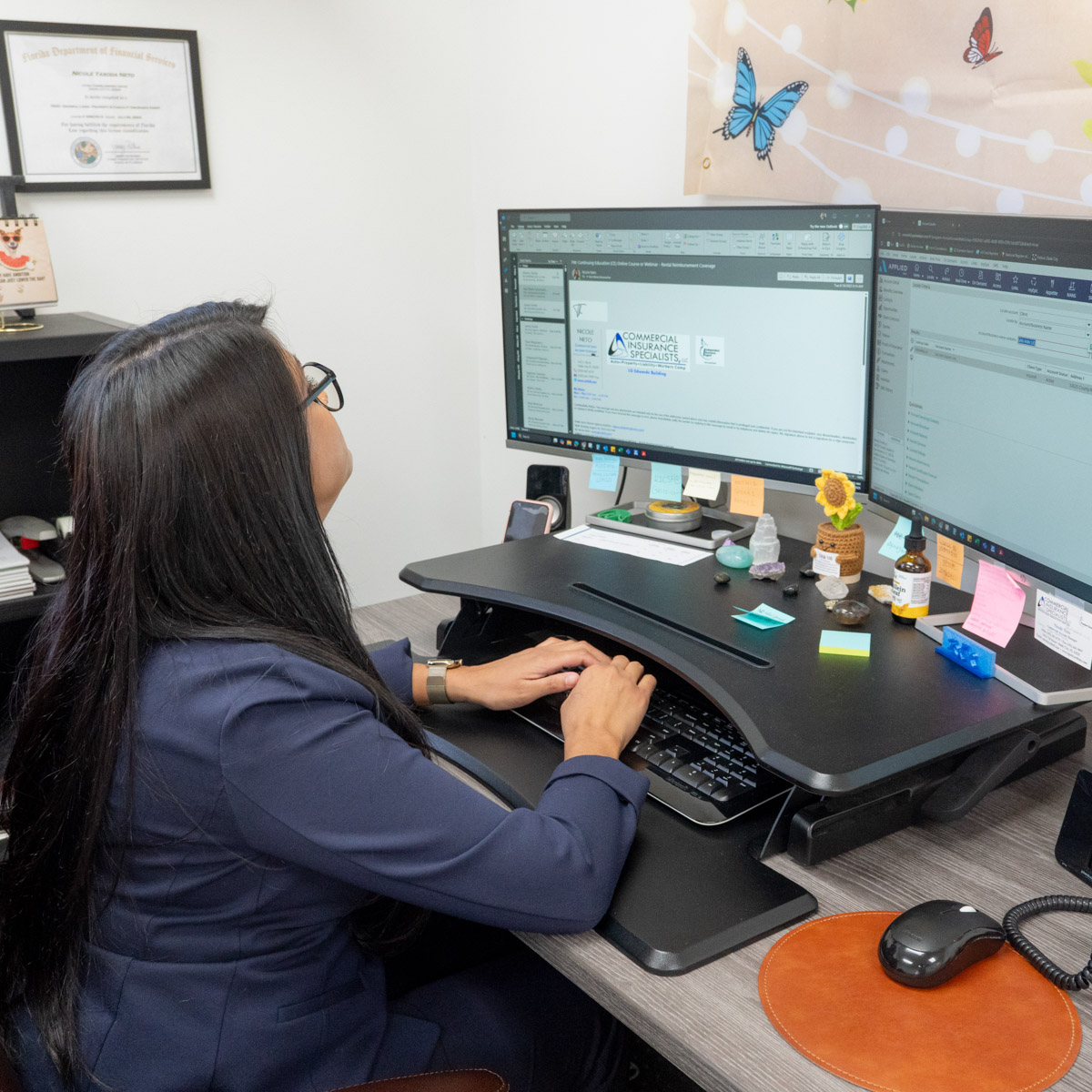

CIS Can Protect Your Florida Business from Reputational Harm

CIS Can Protect Your Florida Business from Reputational Harm

Commercial Insurance Specialists is a Trusted Choice independent agency, which reflects our commitment to providing exceptional service and a broad range of insurance options, including protecting your company from reputational harm and other risks. We understand that every business is unique, which is why we offer tailored solutions to fit your specific needs and budget. We serve clients across multiple industries, including pool & spa contractors, roofers, and plumbers in Carrollwood, Apollo Beach, Largo, Riverview, and surrounding Gulf Coast and Central Florida communities.

Just give us a call, and we will shop around to find the best rates and coverage options for your business from top-rated insurers. Contact us today for a free, no-obligation commercial property insurance quote!